Unlocking Growth Potential in Niche Loan Markets with Participations

As a banker, navigating the ever-changing financial landscape requires strategic thinking and a willingness to explore innovative solutions. One such solution that can open new avenues for growth is loan participations, particularly in niche loan markets. By participating out a portion of your niche loan portfolio to flow buyers, you can unlock a wealth of benefits that can propel your institution's growth potential.

What are Niche Loan Markets?

Niche loan markets refer to specialized lending areas that cater to specific industries, asset classes, or borrower profiles. Examples include aircraft financing, energy lending, agriculture loans, and healthcare financing, microbrewery, equipment, among other asset backed loans. These markets often require deep domain expertise and a thorough understanding of the unique risks and dynamics involved.

The Challenge of Niche Loan Markets

While niche loan markets can be highly lucrative, they also present challenges for banks. Concentration risk, lending limit constraints, and the need for specialized knowledge can limit a bank's ability to fully capitalize on these opportunities. This is where loan participations can be a game-changer.

The Power of Loan Participations

By participating out a portion of your niche loan portfolio to flow buyers, you can unlock several key benefits:

- Diversification and Risk Mitigation: Loan participations allow you to distribute a portion of your risk exposure, reducing concentration risk and maintaining a well-balanced portfolio.

- Increased Lending Capacity: By selling participations, you free up capital and lending capacity, enabling you to originate more loans and capture additional growth opportunities within your niche markets.

- Access to Specialized Expertise: Flow buyers often have deep expertise in specific loan markets, providing you with valuable insights and knowledge that can enhance your lending practices and risk management strategies.

- Expanded Revenue Streams: Loan participations can generate fee income and additional revenue streams, contributing to your institution's overall profitability and growth potential.

- Regulatory Compliance: Participating out loans can help you meet regulatory requirements, such as capital adequacy ratios, while maintaining your desired level of lending activities.

- Increased Customer Base: New customer lending drives opportunities to expand the relationship into other business and deposits.

Connecting with Flow Buyers

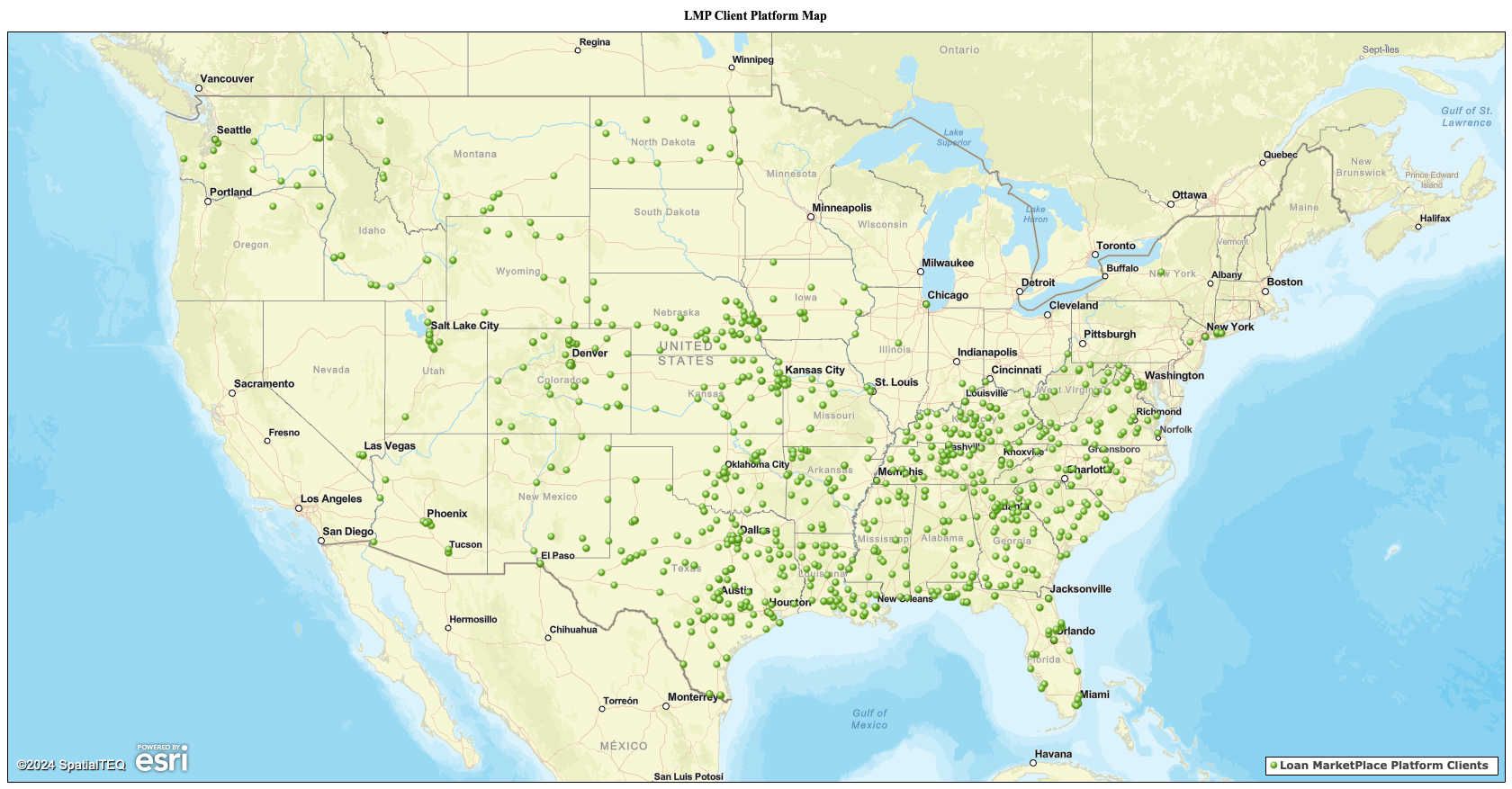

To fully leverage the benefits of loan participations in niche loan markets, it's essential to connect with the right buyers. These are institutional investors or specialized lenders who actively seek participations in specific loan products or markets. One effective way to access a diverse pool of flow buyers is through loan trading platforms like The Loan MarketPlace. Our platform facilitates connections between banks and potential buyers, streamlining the transaction process and ensuring efficient matches based on each party's specific needs and preferences.

By embracing niche loan participations and leveraging the expertise of flow buyers, you can unlock new growth opportunities, diversify your portfolio, and position your institution as a leader in a niche loan market. With a strategic approach and the right partnerships, you can navigate the complexities of these specialized markets while maintaining a healthy balance sheet and driving sustainable growth.

Give me a call to discuss your loan participation strategy or potential niche lending opportunity. There are thousands of lucrative niche lending opportunities in the market looking for the right banking partner. Additional information can be found The Loan MarketPlace website – www.theloanmp.com.

I look forward to hearing from you.